SI.EXPANDTAXSOLUTIONRANGE

Overview

The SI.EXPANDTAXSOLUTIONRANGE function returns the list of Tax solution name field values from the Tax solutions form (Taxes → Setup tab → Tax solutions) in Sage Intacct, which have a defined Tax engine of "VAT or GST".

Syntax

=SI.EXPANDTAXSOLUTIONRANGE(Connection, Range, Status)Arguments

The SI. EXPANDTAXSOLUTIONRANGE function uses the following arguments:

Argument | Required/Optional | Description |

| Required | The name of the connection as configured in the Connection Manager |

| Optional | The range of tax solution names to include in the results. See our article on including multiple argument values |

| Optional | Determines whether or not Tax Solution Names which are marked as inactive within Sage Intacct are included in the results

This argument is available in version 2023.8.45 and higher |

Examples

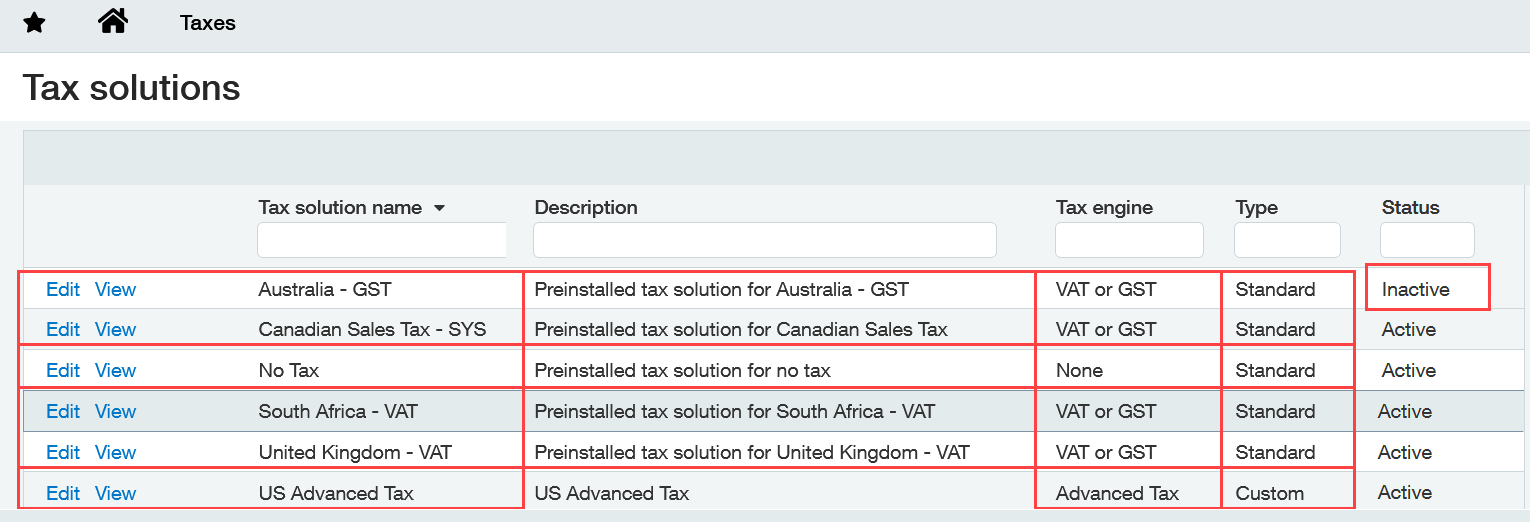

Assuming the following configuration within Sage Intacct:

Example 1

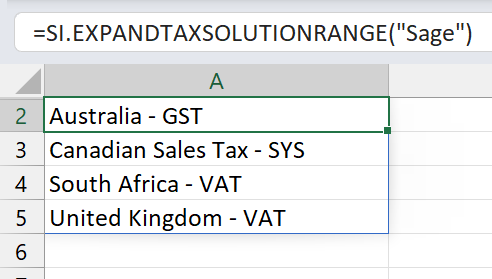

=SI.EXPANDTAXSOLUTIONRANGE("Sage")

Description

Returns the name of all Tax solutions defined in Sage Intacct where the Tax engine field is set to "VAT or GST".

Result

The No Tax solution has been omitted because its Tax engine field is set to empty value.

The US Advanced Tax solution has been omitted because its Tax engine field is set to Advanced Tax.

Example 2

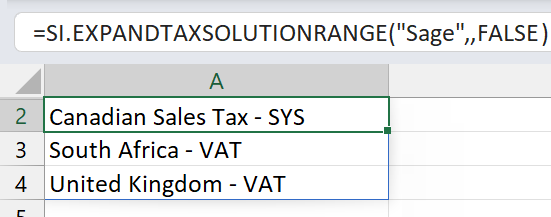

=SI.EXPANDTAXSOLUTIONRANGE("Sage",,FALSE)

Description

Returns the name of all active Tax solutions defined in Sage Intacct where the Tax engine field is set to "VAT or GST".

Result

The inactive Tax Solution Name "Australia - GST" is not included in the results

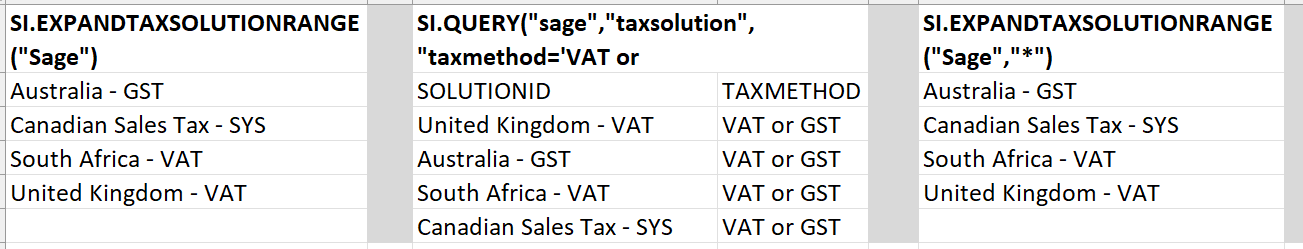

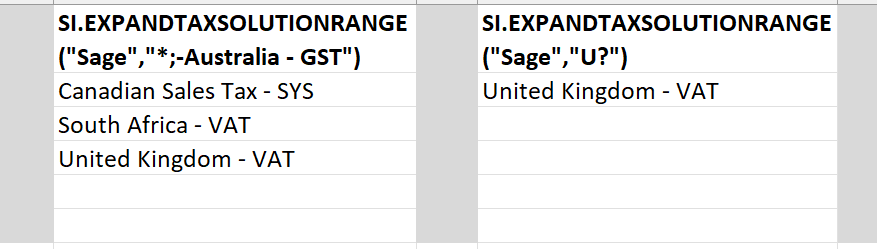

Additional Examples